Large Private Sector Bank

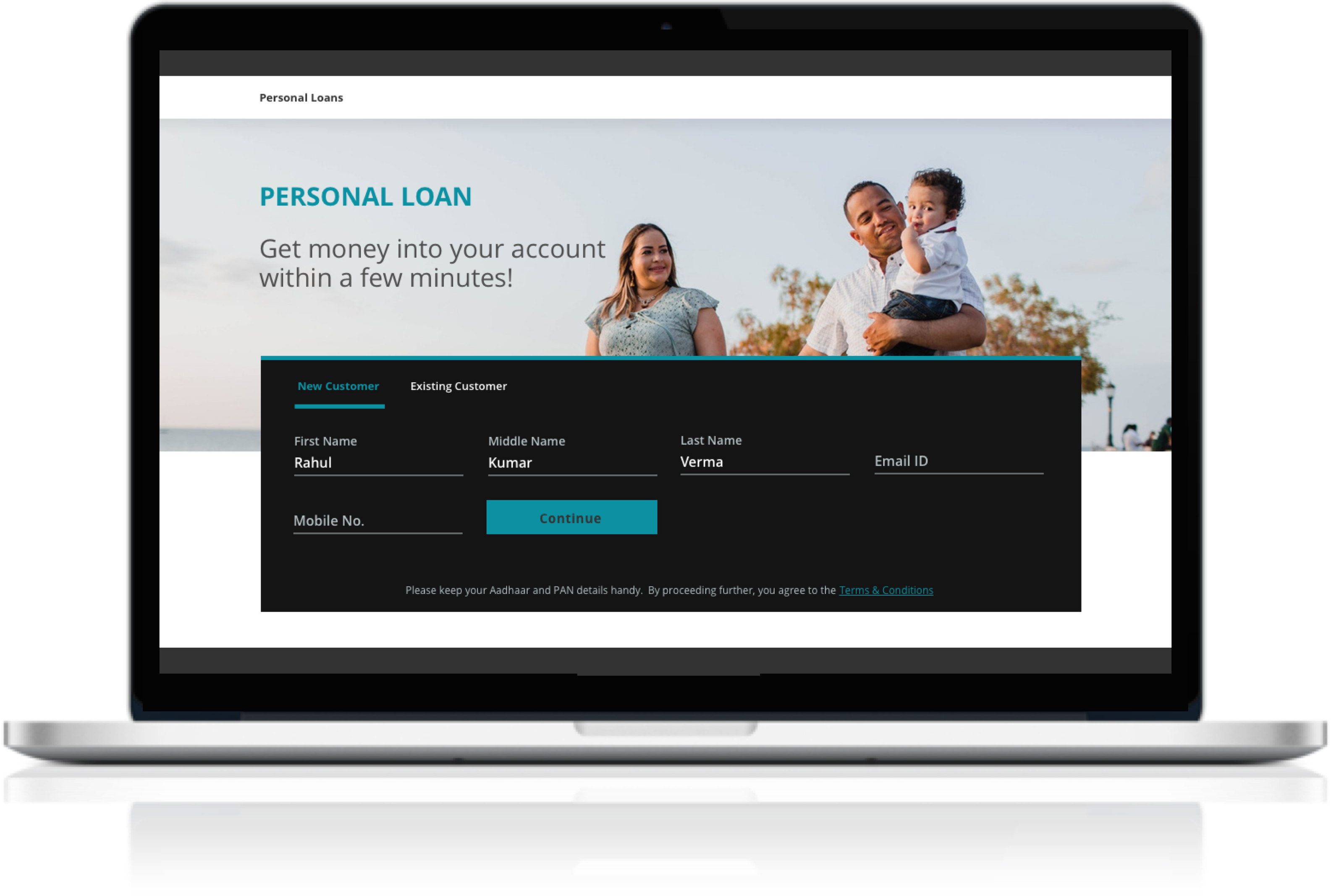

Digital Lending Platform for Retail and SME

- End to End Digital Customer Experience and Middleware platform to digitize the Personal & SME lending space for the bank enabling almost half of Personal Loans acquisition through this digital platform.

- Single platform caters to multiple products powering significant loan book growth for the bank.

- Instant eligibility and disbursement of funds to customers via the platform.

- Multi-channel omnideployment across phone banking, website, internet banking and mobile banking.

- Integrated workflow, underwriting and record management platform.

Leading Global Corporate Card Organisation

Digital Corporate and SME On-Boarding

- Transformation from a manual to a complete digital experience.

- Ecosystem platform for on-boarding, screening, under-writing corporates.

- 85% reduction in time taken for acquiring corporate card customers.

- Seamless integration with alternate trusted data ources for real time data aggregation and verification.

- Single Ecosystem platform for bank’s Partners, Corporates and internal to bank teams to digitally on-board and underwrite corporate card customers.

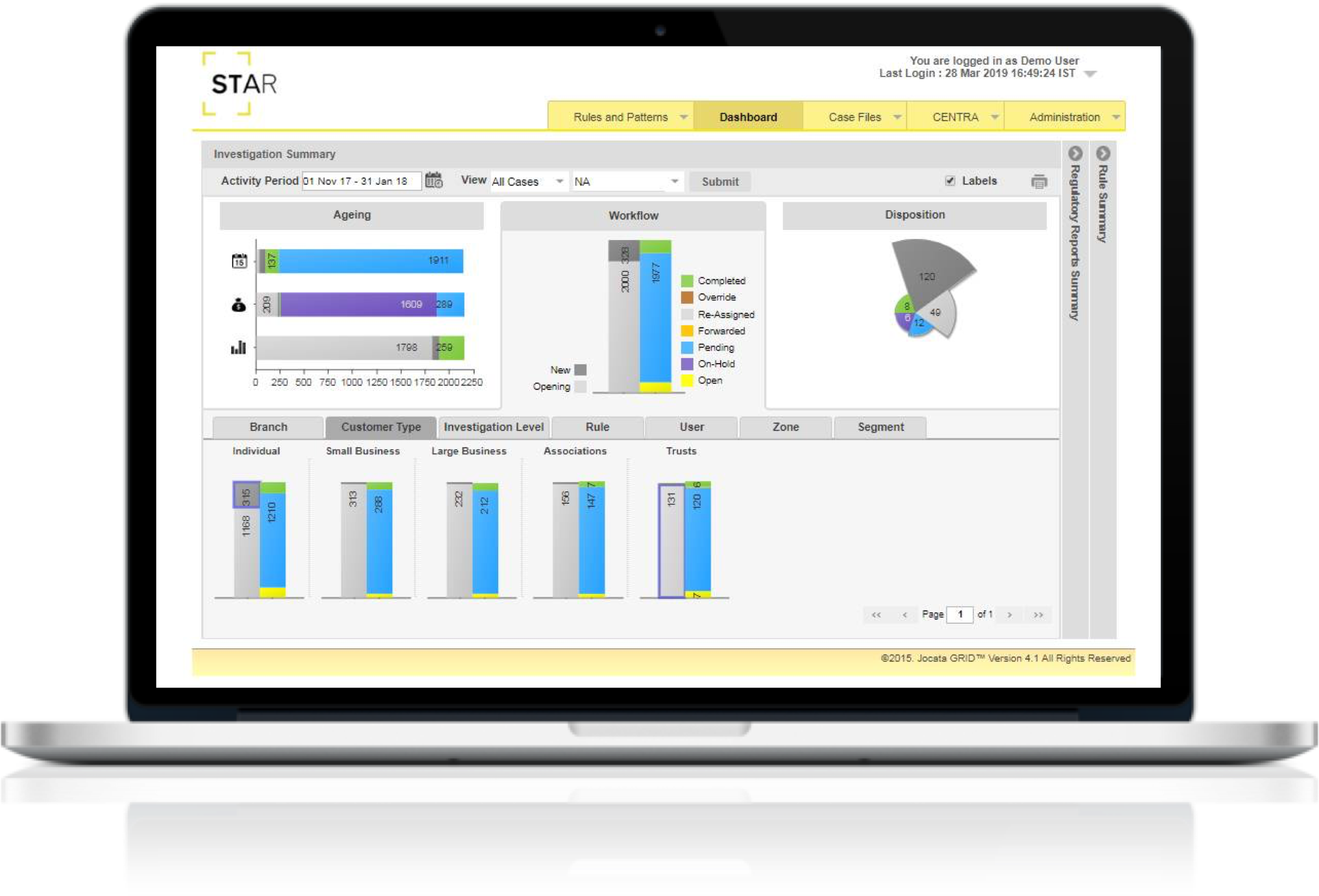

New-Age Digital Payment Bank

AML Compliance

- Artificial Intelligence and Machine Learning powered analytics platform to revamp and digitally transform AML Transaction Monitoring.

- Multi system integration to allow for a 360 degree view of the customer and their transactions.

- On-demand data visualisations for efficient alert review significantly reducing operational TATs.

- Platform delivery at scale to handle over 5 Billion transactions in a year.

- Comprehensive configuration capability inherent to the platform empowering higher flexibility and stabilisation.