What We Do

Our technology platform, Jocata GRIDTM, is a fast, adaptive digital ecosystem that handles millions of transactions per day, delivering solutions that drive business growth, streamline operations, provide risk-adjusted insights, and ensure regulatory compliance.

Business

We boost your Retail and MSME / SME book expansion through real-time data acquisition across internal & external sources, smart underwriting and best in-class customer experience.

Risk

We deliver real-time actionable insights, running relevant customer information through your on-boarding and credit policies configured on the platform.

Operations

Our configurable workflow engine brings all key operational stakeholders onto one unique virtual platform for efficient management and monitoring of business processes.

Compliance

Our AI-based analytics engine helps you not only risk-categorise customers, but also monitor for and report potentially suspicious financial activity including money laundering and real-time fraud.

Business

We boost your Retail and MSME / SME book expansion through real-time data acquisition across internal & external sources, smart underwriting and best in-class customer experience.

Risk

We deliver real-time actionable insights, running relevant customer information through your on-boarding and credit policies configured on the platform.

Operations

Our configurable workflow engine brings all key operational stakeholders onto one unique virtual platform for efficient management and monitoring of business processes.

Compliance

Our AI-based analytics engine helps you not only risk-categorise customers, but also monitor for and report potentially suspicious financial activity including money laundering and real-time fraud.

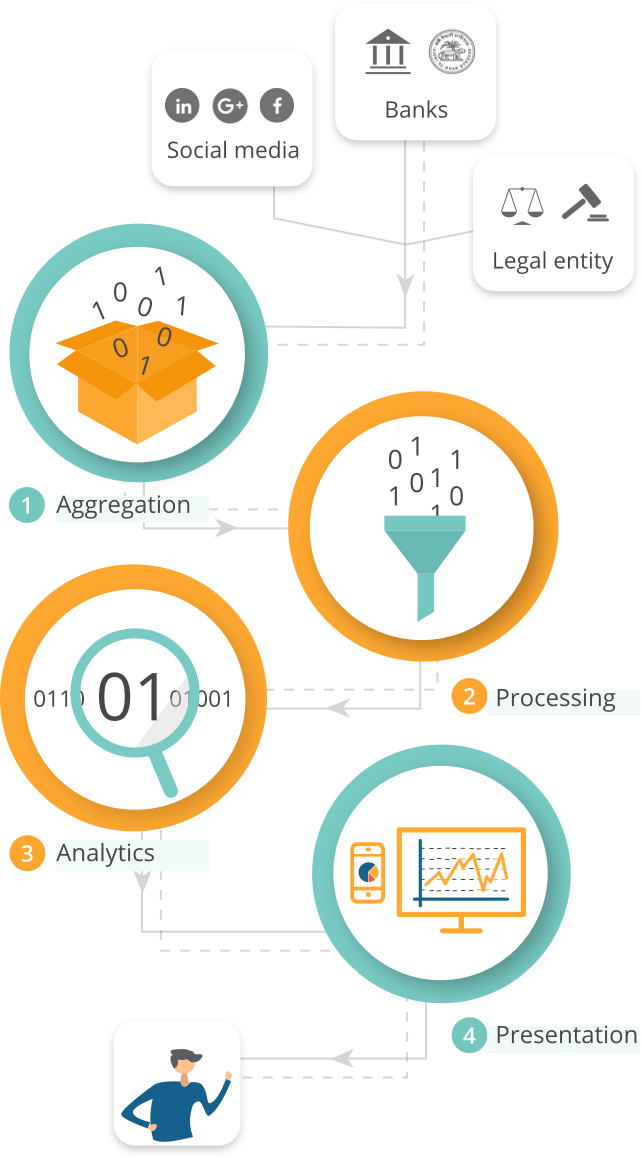

How We Do It

-

Jocata GRIDTM, with its plug-and-play capabilities, builds a robust ecosystem across all your business verticals.

-

From pulling in customer-related information from multiple sources like financial institutions, watchlists, statutory authorities, credit bureaus and social networks, to processing and analyzing it using the latest technologies, and finally, presenting it in the manner most convenient to your customers and you; the GRID does it all.

-

Aggregation

Do you need to source your data digitally?

-

Processing

What do you want to do with your data?

-

Analytics

What insights do you need from your data?

-

Presentation

How do you want to view your data?